Overhead costs must be recouped through revenues for a business to become or remain profitable. Major examples of the individual accounts found in a general ledger include asset accounts, liability accounts, and equity accounts. Each transaction recorded in a general ledger or one of its sub-accounts is known as a journal entry.

What is the difference between an account and a ledger?

Financial institutions charge account holders interest for the privilege of borrowing money in this manner. The Knights Templar were the first to hold assets on behalf of others and make loans on those assets. As such, the Knights Templar are sometimes credited with creating the foundations of today’s banking system. Accounts were first created so that people could borrow to travel to the Holy Land and hold and amass wealth that was often stolen during the Crusades.

Other types of deposit products for savers

Balance sheet accounts like assets, liabilities, and shareholder’s equity are shown first, and then come income statement accounts like revenue and expenses, in the order they appear on your financial statements. You may also wish to break down your business’ COA according to product line, electronic filing company division, or business function, depending on your unique needs. Every transaction needs to be recorded and accounted for properly so that a company’s financial statements are accurate. If not, a company could think it has more or less cash flow, or profits, than it actually has.

Accounting Process

An accountant is a professional with a bachelor’s degree who provides financial advice, tax planning and bookkeeping services. They perform various business functions such as the preparation of financial reports, payroll and cash management. A chart of accounts gives you great insight into your business’s revenue beyond just telling you how much money you earn. It shows peaks and valleys in your income, how much cash flow is at your disposal, and how long it should last you given your average monthly business expenses. The chart of accounts allows you to organize your business’s complex financial data and distill it into clear, logical account types. It also lays the foundation for all your business’s important financial reports.

- Accounting also supplies management with significant financial data useful for decision making.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

- This guide serves as an easy-to-use resource for developing the vocabulary used by accounting professionals.

- The term is sometimes used alongside “operating cost” or “operating expense” (OPEX).

- As an example, consider a company that outsourced work to an external contractor.

Accounting is the process of recording, classifying and summarizing financial transactions. It provides a clear picture of the financial health of your organization and its performance, which can serve as a catalyst for resource management and strategic growth. Yes, it is a good idea to customize your chart of accounts to suit your unique business. Charts of accounts are an index, or list, of the various financial accounts that can be found in your company’s general ledger. These accounts are separated into different categories, including revenue, liabilities, assets, and expenditures.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. If an event has a financial implication for a business unit, it must make a record of such an event. In recent years, there has been a growing demand on the part of stakeholders for information concerning the social impacts of corporate decision making. Increasingly, companies are including additional information about environmental impacts and risks, employees, community involvement, philanthropic activities, and consumer safety.

Accountants use “initial inventory plus purchases, minus ending inventory” as a basic accounting formula for calculating COGS over a specific accounting period. You can outsource your accounting work to outside professionals who specialize in bookkeeping and tax preparation. Outsourcing can offer many advantages because it allows you to take advantage of specialized skill sets that may not be available when hiring someone in-house. A certified public accountant (CPA) is a type of professional accountant with more training and experience than a typical accountant. Aspiring CPAs are expected to have a bachelor’s degree, more than two years of public accounting work experience, pass all four parts of the CPA exam and meet additional state-specific qualifications if required.

The COA tracks your business income and expenses, which you’ll need to report on your income tax return every year. The work performed by accountants is at the heart of modern financial markets. Without accounting, investors would be unable to rely on timely or accurate financial information, and companies’ executives would lack the transparency needed to manage risks or plan projects.

It’s not only important for businesses in terms of record keeping and general business management, but also for legal reasons and tax purposes. Though many businesses leave their accounting to the pros, it’s wise to understand the basics of accounting if you’re running a business. To help, we’ll detail everything you need to know about the basics of accounting.

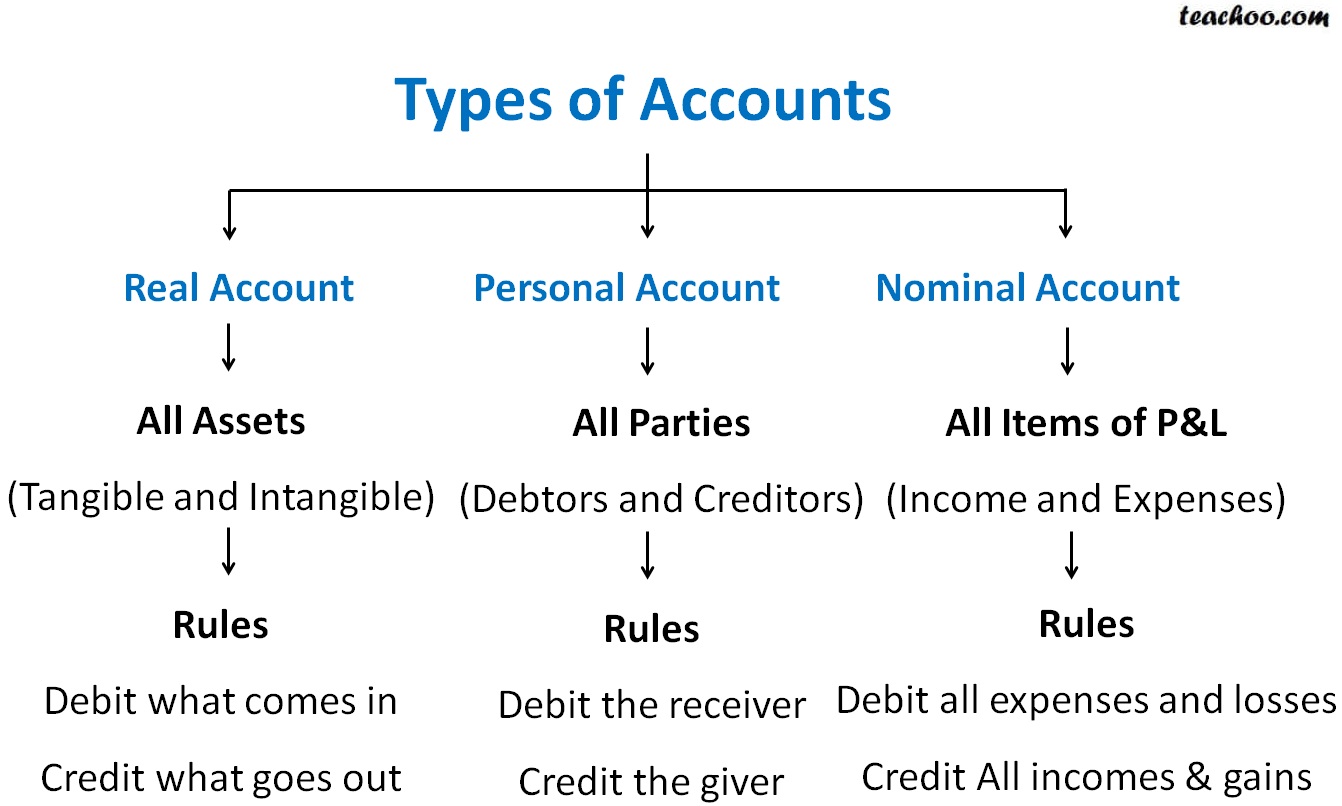

Assets are resources your business owns that can be converted into cash and therefore have a monetary value. Examples of assets include your accounts receivable, loan receivables and physical assets like vehicles, property, and equipment. Accountants may be tasked with recording specific transactions or working with specific sets of information. For this reason, there are several broad groups that most accountants can be grouped into. Also known as temporary accounts, nominal accounts include revenue accounts, expense accounts, and withdrawal accounts.